The real estate market of the past few years has reshaped the American dream. With housing inventory remaining tight and property values holding strong across the United States, homeowners are increasingly choosing to upgrade their current residences rather than brave the highly competitive purchasing market. Whether it is a full kitchen overhaul, a primary suite addition, or finishing a basement to create a modern home office, the desire to remodel is at an all-time high. Fortunately, the average homeowner is sitting on a historic amount of home equity, providing a powerful financial tool to fund these extensive projects.

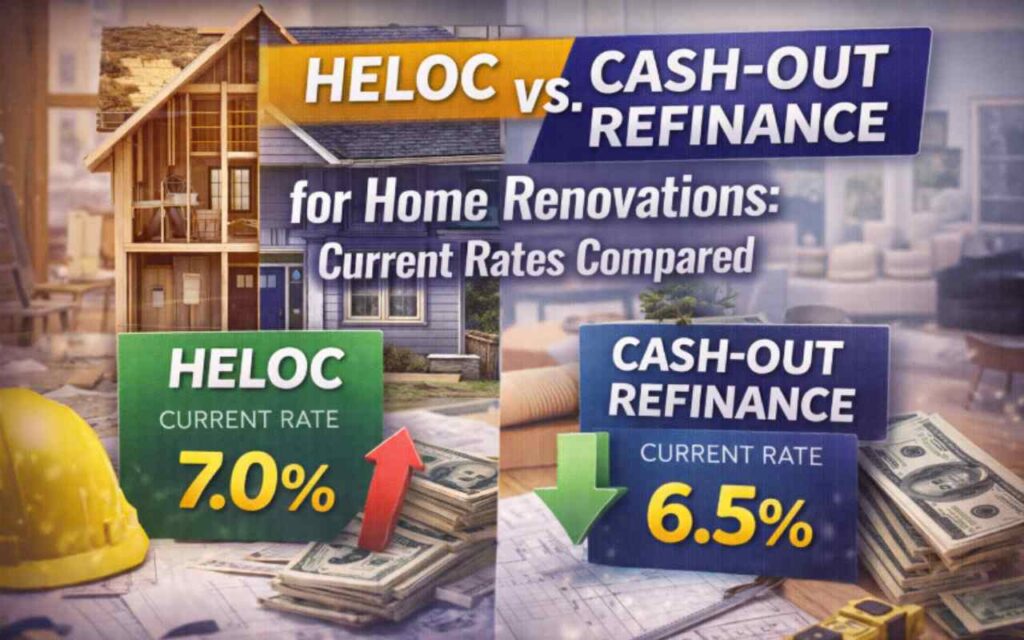

However, deciding exactly how to tap into that wealth can be a daunting financial puzzle. Two primary options dominate the landscape, and for those grappling with the choice, diving into the details of HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026 is an absolute necessity. Both avenues allow you to convert your property’s equity into liquid cash, but they operate under fundamentally different mechanics, carry different risk profiles, and feature distinct cost structures. Making the wrong choice could cost you tens of thousands of dollars in unnecessary interest and fees over the life of your loan.

The Golden Age of Home Equity

To understand the current borrowing environment, one must look at the broader macroeconomic picture. Property values surged dramatically in the early years of the decade and, despite fluctuating interest rates, have largely retained those elevated valuations. Consequently, the average homeowner in the United States possesses hundreds of thousands of dollars in untapped equity.

Equity is simply the current market value of your home minus the outstanding balance of your mortgage. If your house is worth five hundred thousand dollars and you owe three hundred thousand dollars, you have two hundred thousand dollars in equity. Lenders generally allow you to borrow up to eighty or eighty-five percent of your home’s total value, meaning a substantial portion of that wealth can be liquefied. Instead of putting renovations on high-interest credit cards or draining hard-earned retirement savings, leveraging your home is generally the most cost-effective way to fund major construction.

Decoding the Home Equity Line of Credit

A Home Equity Line of Credit acts very much like a high-limit credit card secured by your house. Rather than receiving a lump sum of cash on day one, the lender approves you for a maximum borrowing limit. You can draw from this line of credit as needed using a specialized debit card or checking account linked to the HELOC.

This structure is highly advantageous for home renovations, which are notoriously unpredictable. If your contractor estimates a project will cost sixty thousand dollars, but unforeseen plumbing issues push the total to seventy-five thousand dollars, a HELOC provides the flexibility to draw exactly what you need, when you need it. You only pay interest on the outstanding balance, not the entire approved limit.

Furthermore, HELOCs are divided into two distinct phases. The first is the draw period, which typically lasts ten years. During this time, you can borrow, repay, and borrow again, and you are usually only required to make interest-only payments, keeping your monthly cash flow highly manageable while construction is underway. Following the draw period is the repayment period, usually lasting twenty years, during which you can no longer access funds and must make fully amortizing payments of both principal and interest to clear the debt.

When analyzing HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026, it is crucial to note that HELOCs carry variable interest rates. These rates are tied directly to the United States Prime Rate, which moves in tandem with the Federal Reserve’s benchmark federal funds rate. If the Federal Reserve cuts rates, your HELOC payment drops. Conversely, if inflation surges and the central bank hikes rates, your borrowing costs will climb.

The Mechanics of a Cash-Out Refinance

Unlike a HELOC, which functions as a second mortgage layered on top of your existing one, a cash-out refinance wipes the slate clean. This process involves taking out an entirely new primary mortgage that is larger than your current outstanding balance. The new loan pays off the old debt, and the difference is distributed to you as a single, lump-sum cash payment at closing.

Because it replaces your primary mortgage, a cash-out refinance is usually secured with a fixed interest rate. Your monthly payment is entirely predictable for the next fifteen to thirty years, shielding you from the volatility of the Federal Reserve’s monetary policy. This provides tremendous peace of mind for homeowners who prefer a rigid, unchanging monthly budget.

However, the lump-sum nature of the payout means you begin paying interest on the full amount immediately. If you take out fifty thousand dollars for a backyard overhaul but the landscaper does not break ground for six months, you are paying interest on that idle cash sitting in your bank account. As we explore the topic of HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026, it becomes clear that giving up a historic low rate on a primary mortgage is the biggest deterrent for the refinance route.

Evaluating the Current Rate Environment

The borrowing landscape has shifted notably as we progress through 2026. After a period of aggressive rate hikes a few years prior, the Federal Reserve has engaged in a cycle of gradual rate cuts aimed at stabilizing a normalizing labor market and cooling inflation. This has brought welcome relief to the housing sector.

Currently, the national average interest rate for a new HELOC hovers between seven and a quarter percent to eight percent for borrowers with excellent credit. However, many competitive lenders and credit unions are offering aggressive introductory rates—sometimes as low as five percent—for the first six to twelve months of the loan.

On the other side of the aisle, the national average annual percentage rate for a thirty-year cash-out refinance sits comfortably in the mid-six percent range, frequently landing around six and a half percent. For homeowners willing to compress their repayment schedule, a fifteen-year fixed cash-out refinance can yield even lower rates, often dropping into the high-five percent territory.

While cash-out refinances boast lower nominal interest rates than HELOCs, borrowers must be careful not to view these percentages in a vacuum. A slightly lower rate on a massive new primary mortgage may ultimately cost much more than a slightly higher rate on a small, secondary line of credit.

A Detailed Look at the Data

To make an informed decision, examining the specific features and costs side-by-side is essential. Any rigorous discussion surrounding HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026 must account for these shifting baseline figures and the anticipated trajectory of the federal funds rate.

Upfront Costs and Hidden Fees

One of the most drastic differences between these two financing methods lies at the closing table. A cash-out refinance is a full mortgage origination. This means you will be subjected to the entire suite of closing costs you likely paid when you first bought the home. These fees include a new appraisal, title search, title insurance, loan origination fees, and potentially discount points to buy down your interest rate.

Because closing costs on a refinance typically range from two to six percent of the entire loan amount, the math can be staggering. If you owe two hundred and fifty thousand dollars on your current home and want to pull out fifty thousand dollars for a kitchen remodel, your new loan will be three hundred thousand dollars. A three percent closing cost equates to nine thousand dollars in fees just to access your fifty thousand dollars in equity.

Conversely, the data within HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026 reveals stark differences in upfront closing costs. Because a HELOC is a secondary product, lenders often absorb the setup costs to win your business. Many banks charge absolutely zero closing costs, while others might mandate a nominal annual maintenance fee or a minor charge for a drive-by appraisal. For homeowners looking to preserve their working capital for the actual construction materials rather than bank fees, the HELOC presents a massive advantage.

The Psychological Hurdle of Resetting Your Mortgage

Perhaps the most significant factor preventing homeowners from utilizing a cash-out refinance today is the “lock-in effect.” Millions of Americans secured primary mortgages during the unprecedented low-rate environment of 2020 and 2021, locking in thirty-year fixed rates under four percent.

If you currently hold a mortgage at three percent, initiating a cash-out refinance means permanently destroying that historically favorable debt. You would be resetting your entire mortgage balance to the current market rate of roughly six and a half percent. Over the remaining life of a thirty-year loan, that rate jump will result in hundreds of thousands of dollars in additional interest payments, completely negating any benefit gained from pulling out the cash.

For these borrowers, the HELOC is the undisputed champion. By taking out a HELOC, your original primary mortgage—and its beautiful three percent rate—remains entirely untouched. You are only paying the current market rate of seven or eight percent on the newly borrowed renovation funds. Blending a large mortgage at three percent with a small HELOC at eight percent results in an effective interest rate that is still vastly superior to refinancing the entire property at today’s rates.

However, if you purchased your home recently—perhaps in late 2023 or 2024 when mortgage rates spiked over seven and a half percent—a cash-out refinance in 2026 might actually lower your primary interest rate while simultaneously providing the cash needed for your remodel. In this specific scenario, the cash-out refinance becomes an incredibly powerful wealth-building tool.

Appraisals and Loan-to-Value Requirements in Today’s Market

Regardless of the path you choose, your ability to borrow hinges on your home’s appraised value. Lenders calculate a metric known as the Combined Loan-to-Value ratio to determine your borrowing power. Most conservative lenders cap this ratio at eighty percent, though some specialized credit unions may stretch it to ninety percent for borrowers with impeccable credit profiles.

Consider a mathematical example: If an independent appraiser determines your home is worth six hundred thousand dollars in 2026, an eighty percent maximum limit dictates that all debts secured against the property cannot exceed four hundred and eighty thousand dollars. If your current mortgage balance is three hundred and fifty thousand dollars, you have one hundred and thirty thousand dollars of accessible borrowing power.

Appraisals in the current market are rigorous. If you are banking on a specific equity number to fund a major addition, you must ensure your home is in presentable condition before the appraiser arrives. Furthermore, localized market cooling in certain regions means that assumed equity may not always align with the appraiser’s final report.

Tax Implications for Your Project

Navigating the Internal Revenue Code is an essential component of responsible borrowing. The United States tax code features specific provisions regarding the deductibility of interest paid on home equity debt. Under current legislation, you can deduct the interest paid on a HELOC or a cash-out refinance, but only if a very strict condition is met: the borrowed funds must be used to “buy, build, or substantially improve” the home that secures the loan.

This means that if you use your HELOC to put a new roof on your house, add a master bathroom, or completely renovate your kitchen, the interest paid on that debt is generally tax-deductible, provided you itemize your deductions on your annual tax return. However, if you pull equity out of your home to pay off high-interest credit card debt, fund a child’s college tuition, or purchase a luxury vehicle, the interest loses its tax-advantaged status.

Furthermore, the Internal Revenue Service enforces a cap on the total amount of mortgage debt that qualifies for the deduction. For married couples filing jointly, you can only deduct interest on up to seven hundred and fifty thousand dollars of qualified residence loans. While evaluating HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026, consulting a certified public accountant is highly recommended to ensure you maximize your tax benefits while remaining fully compliant with federal regulations.

Strategies for Securing the Best Terms

Interest rates advertised by massive financial institutions represent best-case scenarios reserved for top-tier borrowers. To secure the lowest possible rates in 2026, homeowners must proactively manage their financial profiles before submitting a loan application.

First, scrutinize your credit score. To unlock the prime rates hovering in the low seven percent range for HELOCs or mid-six percent for refinances, you generally need a FICO score of seven hundred and forty or higher. If your score sits in the mid-six hundreds, you will face significant rate premiums that will drastically increase your monthly payments.

Also Read How to Invest in AI Data Centers and Tech Real Estate Funds 2026?

Second, calculate your debt-to-income ratio. Lenders divide your total monthly debt obligations by your gross monthly income. Ideally, your total debt, including your new estimated loan payment, should not exceed forty percent of your gross income. Paying down smaller consumer debts before applying for a home equity product can strengthen your application and result in more favorable loan terms.

Finally, do not accept the first offer presented by your primary bank. The lending market is highly competitive. Local credit unions frequently offer HELOCs with significantly lower margins above the prime rate compared to major national banks. Mortgage brokers can also shop your cash-out refinance scenario to dozens of wholesale lenders simultaneously, ensuring you receive the absolute lowest annual percentage rate available in your zip code.

Choosing the Right Path for Your Needs

Remodeling your home is a massive undertaking that requires careful planning, patience, and robust financial backing. The equity trapped within your property’s walls is a potent resource, but unlocking it requires a strategic approach tailored to your specific financial situation.

If you are currently holding a primary mortgage with an interest rate below five percent, or if you are undertaking a phased renovation where costs may fluctuate over several months, the Home Equity Line of Credit is likely your superior option. It preserves your historically low primary rate, minimizes your upfront closing costs, and provides unparalleled flexibility to draw funds precisely when your contractors require payment.

Conversely, if you purchased your home during the peak rate frenzy of recent years, or if you are engaging in a single, massive project that requires a massive lump sum immediately, the cash-out refinance deserves a close look. Locking in a lower fixed rate for the next three decades provides budgetary stability that variable products simply cannot match.

Ultimately, the right answer in the debate of HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026 depends entirely on your existing mortgage terms, your project timeline, and your long-term financial goals. By carefully analyzing the current rate environment, understanding the hidden costs, and accurately assessing your home’s appraised value, you can confidently secure the capital needed to transform your current house into your ultimate dream home.

Conclusion

As we wrap up our comprehensive look at HELOC vs. Cash-Out Refinance for Home Renovations: Current Rates Compared 2026, the overarching theme is the strategic preservation of your primary mortgage rate. The Federal Reserve’s recent rate stabilization in early 2026 has provided a much-needed breather for the housing market, bringing borrowing costs down from their previous historic peaks. However, with the national average for a thirty-year cash-out refinance hovering around six and a quarter percent, throwing away a pandemic-era three percent mortgage is a mathematical misstep for most households.

For the vast majority of homeowners executing phased remodels, the Home Equity Line of Credit remains the supreme financial tool.

The HELOC isolates the higher borrowing costs strictly to the renovation budget while keeping the primary mortgage entirely intact. You only pay for what you draw, and you avoid the massive closing costs associated with a full mortgage origination. Conversely, if you recently purchased a home at the peak of the rate cycle in 2023 or 2024, a cash-out refinance in today’s slightly cooler rate environment could offer the rare dual benefit of lowering your primary interest rate while simultaneously extracting a massive lump sum for a major addition. Ultimately, your choice dictates your financial flexibility for decades to come. Protect your equity, calculate your break-even point on closing costs, and secure the capital needed to build your dream home.

Frequently Asked Questions

Can I deduct the interest on my home equity loan or refinance on my taxes?

Yes, but with strict limitations. According to the internal revenue code, you can only deduct the interest paid on home equity debt if the borrowed funds are used exclusively to “buy, build, or substantially improve” the property that secures the loan. If you use a HELOC to upgrade your kitchen or build an addition, the interest is generally tax-deductible if you itemize your deductions. If you use the funds to consolidate credit card debt or buy a luxury vehicle, the interest loses its tax-advantaged status. For detailed tax guidance, you can review the official parameters regarding the mortgage interest deduction directly on the Internal Revenue Service website.

What are the average rates for home equity products right now?

As of early 2026, rates have eased from their previous peaks but remain dependent on your creditworthiness.

What happens to my HELOC payment if the Federal Reserve cuts rates again?

Because HELOCs carry variable interest rates tied to the United States Prime Rate, your required monthly payment will automatically decrease if the Federal Reserve cuts its benchmark federal funds rate. Conversely, if inflation rebounds and the central bank is forced to hike rates, your HELOC interest rate—and your monthly interest-only payment—will increase.

Is it harder to qualify for a cash-out refinance than a HELOC?

Generally, yes. A cash-out refinance replaces your primary mortgage entirely, which requires a rigorous, full-scale underwriting process. Lenders will heavily scrutinize your debt-to-income ratio, demand a brand new full interior appraisal, and typically require a credit score of at least six hundred and twenty (though the prime rates listed above require a score over seven hundred and forty). HELOCs are often underwritten much faster, sometimes utilizing automated valuation models or exterior drive-by appraisals instead of full physical inspections.

Do I have to pay closing costs on a HELOC?

One of the biggest advantages of a HELOC is the minimal upfront cost. The vast majority of lenders waive traditional closing costs to attract your business, meaning you can often open the line of credit for zero dollars out of pocket. In contrast, a cash-out refinance requires you to pay standard mortgage origination fees, title insurance, and appraisal costs, which typically amount to two to six percent of the total new loan balance.

If I do not use all the money in my HELOC, do I still pay interest on it?

No. A HELOC functions as a revolving line of credit. If you are approved for a one-hundred-thousand-dollar limit but only draw forty thousand dollars to pay your general contractor, you only accrue interest on the forty thousand dollars you actively borrowed. With a cash-out refinance, you receive the entire lump sum on closing day and begin paying interest on the full amount immediately, regardless of whether you have spent the funds yet.

Pingback: Best Credit Cards in USA 2026: Rates, Fees, and Hidden Costs - Legal News Updates